Posted in KTFCU News, Newsletter on Nov 03, 2025

Posted in KTFCU News on Oct 31, 2025

Our Certificate of Deposit rates are very competitive. Have your money earn interest for YOU.

3.50% apy. $ 5,000 & up 12 month term

3.75% apy. $10,000 & up 12 month term

Just give us a call at 716-877-1630 and we'll have your money earning dividends.

Rates shown for October 1, 2025. Subject to change without notice. Other restrictions may apply.

Posted in Board Brief on Oct 14, 2025

THE MOST DECEPTIVE TEXT SCAMS ARE THE SIMPLEST OR CLOSEST TO REALITY.

Here are two examples:

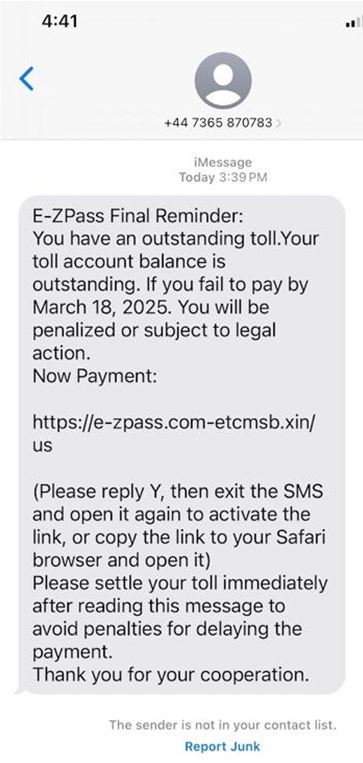

EZ Pass Scam

This Scam text is very, very deceptive because it looks legitimate and is very relevant to many New Yorkers. At least, it looks legitimate until you look closely at the link you are asked to click on (e-zpass.com-etcmsb.xin/us) and the phone number (+44 77365 870783).

You should know the official EZ-Pass URL for NY State is e-zpassny.com. The link e-zpass.com takes you to a spurious site. Also, EZ-Pass does not send texts from the United Kingdom (+44)! Delete it.

Personal Contact Scam

I...