Posted in Board Brief, KTFCU News on Feb 18, 2026

More retailers are offering BUY NOW, PAY LATER (BNPL) No-Interest Services. From grocery stores to home improvement stores to apparel stores, many retailers are offering these products. Currently, according to WalletHub-

61% of Americans do not know how differed interest or no interest BNPL purchases work.

51% of Americans say they have agreed to a BNPL plan without being sure they could make the monthly payments.

What are BNPL's? Should I consider taking advantage of them? What are the pitfalls?

First and foremost, these are financial products in the same way a credit card is a financial pro...

Posted in Board Brief, KTFCU News on Jan 21, 2026

Last Board Brief, we looked at the ways you can transfer money into your KTFCU accounts. In this Board Brief, we look at best practices for moving your money into your KTFCU accounts.

MONEY TRANSFER BEST PRACTICES

General Overview – Money Transfers Into the KTFCU

In general, there are three important types of accounts; Share Savings, Share Draft and, if applicable, Loans.

Overall, it is best to move your money into either your Share Savings or Share Draft account from outside sources before you move the money between your other account(s).

Most of you use Online Banking or the Online Bankin...

Posted in Board Brief, KTFCU News on Dec 17, 2025

There is a new way to instantly move money electronically into your KTFCU account from other financial institutions. So, we want to take this opportunity to talk about all the ways you can transfer money into your KTFCU accounts.

Whichever method you choose, find more information and “How-To” instructions on our website at https://www.kenteachfcu.com/directdeposit.

THE NEW WAY TO TRANSFER

Instant FedNow Transfers

Instant Transfers are electronic money transfers that make funds available to the recipient within seconds, operating 24/7, 365 days a year. The major benefit is you have immediate ac...

Posted in Board Brief, KTFCU News on Nov 19, 2025

It's the holidays! 'Tis the season to celebrate with families and friends. It's also the most active time for shipping- online and in store. We have been buying online for many years. Each year, we see increasing schemes conjured up by scammers. We’ve documented many of them here. We want to remind you to be diligent about these scams. The newest scams involve using your personal info against you, using purposefully misleading information or using call-to-action threats. Let's look at each one.

USING YOUR PERSONAL INFORMATION AGAINST YOU

The most disturbing new scam involves a phone call and y...

Posted in Board Brief on Oct 14, 2025

THE MOST DECEPTIVE TEXT SCAMS ARE THE SIMPLEST OR CLOSEST TO REALITY.

Here are two examples:

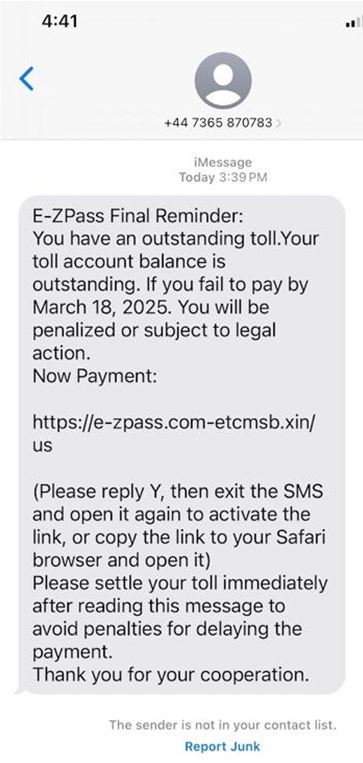

EZ Pass Scam

This Scam text is very, very deceptive because it looks legitimate and is very relevant to many New Yorkers. At least, it looks legitimate until you look closely at the link you are asked to click on (e-zpass.com-etcmsb.xin/us) and the phone number (+44 77365 870783).

You should know the official EZ-Pass URL for NY State is e-zpassny.com. The link e-zpass.com takes you to a spurious site. Also, EZ-Pass does not send texts from the United Kingdom (+44)! Delete it.

Personal Contact Scam

I...